Problem

Definition

a. Background

To The Problem:

Banking

operations are becoming increasingly customer dictated. The demand for 'banking

super malls' offering one-stop integrated financial services is well on the

rise. The ability of banks to offer clients access to several markets for

different classes of financial instruments has become a valuable competitive

edge. With the phenomenal

increase in the country's population and the increased demand for banking

services; speed, service quality and customer satisfaction are going to be key

differentiators for each bank's future success. Thus it is imperative for

banks to get useful feedback on their actual response time and customer service

quality aspects of retail banking, which in turn will help them take positive

steps to maintain a competitive edge.

The

working of the customer's mind is a mystery which is difficult to solve and

understanding the nuances of what customer satisfaction is, a challenging task.

This exercise in the context of the banking industry will give us an insight

into the parameters of customer satisfaction and their measurement. This vital

information will help us to build satisfaction amongst the customers and

customer loyalty in the long run which is an integral part of any business. The customer's requirements must be translated

and quantified into measurable targets. This provides an easy way to monitor

improvements, and deciding upon the attributes that need to be concentrated on

in order to improve customer satisfaction. We can recognize where we need to

make changes to create improvements and determine if these changes, after implemented,

have led to increased customer satisfaction. "If you cannot measure

it, you cannot improve it." - Lord William Thomson Kelvin (1824-1907).

b.

Statement Of The Problem:

This paper identifies the

factors that relate to customer satisfaction in the banking industry, the most

important factors among the proposed factors, determining the importance of

these factors and identifying their level of satisfaction. It also suggests

some ways the banks can follow to improve the level of customer satisfaction regarding

it.

Therefore, the specific

objectives of the paper are:

1. To

identify the factors that relate to customer satisfaction in Banks

2. To

determine the most important factor among the proposed factors

3. To

determine the importance of each proposed factor

4. To

determine the level of satisfaction

c.

Limitations:

The

study has some limitations; which are:

»

Sampling

Technique

The

sampling technique of this study is convenient sampling which is a

non-probability sampling technique. Therefore, the samples considered here may

not be representative of the defined population. As a result, the

generalizability of the findings is quite low.

»

Sampling

Error

As

the sample size is only 56, random sampling error is occurred in this study.

»

Respondent

Error

In

some cases, it is found that respondents are unable to remember the actual

response. This inability has led to errors of omission, telescoping, and

creation.

Literature Review

Customer

satisfaction represents a modern approach for quality in enterprises and

organizations and serves the development of a truly customer-focused management

and culture. Customer satisfaction is a key and valued outcome of good

marketing practice. According to Drucker (1954), the principle purpose of a

business is to create satisfied customers. Increasing customer satisfaction has

been found to lead to higher future profitability (Anderson, Fornell, and

Lehmann 1994), lower costs related to defective goods and services (Anderson,

Fornell, and Rust 1997), increased buyer willingness to pay price premiums,

provide referrals, and use more of the product (Reichheld 1996; Anderson and

Mittal 2000), and higher levels of customer retention and loyalty (Fornell

1992; Anderson and Sullivan 1993; Bolton 1998). In another study Increasing

loyalty, in turn, has been found to lead to increases in future revenue

(Fornell 1992; Anderson, Fornell, and

Lehmann 1994) and reductions in the cost of future transactions (Reichheld

1996; Srivastava, Shervani, and Fahey 1998).

Measuring

customer satisfaction offers an immediate, meaningful and objective feedback

about clients’ preferences and expectations. In this way, company’s performance

may be evaluated in relation to a set of satisfaction dimensions that indicate

the strong and the weak points of a business organization. (Mihelis

et al, 1999). customer loyalty to profitability and profitability. An estimate of the effects

of increased customer satisfaction on profitability suggests that attainable

increases in satisfaction could dramatically improve profitability. (Roger

Hallowell, 1996). This makes it possible to hold customer satisfaction programs

accountable, in the way that other business programs are held accountable, by

forcing them to demonstrate their benefits with respect to bottom-line

profitability loyalty and retention of customers also depend on the overall

customer satisfaction. (Rust

& Zahorik, 2002). The American Customer Satisfaction Index

(ACSI) indicates that loyalty is a great factor that defines the customer

satisfaction (Fornell et. al, 1996). Tantakasem and Lee says that today’s the

strategy of service related industry is to win the customer satisfaction by

providing superior service. This study enhances the relationship between

customer satisfaction and service quality. If the customer is fully satisfied

then he will be loyal with the bank otherwise he will switch off to that bank

which provides the better services. Gremler and W.Brown describes that business

are not concerned only with attracting and satisfying customers but also to

maintain a long-term relationship with the customers. When the customer is

satisfied with the banks services then ultimately he will maintain his business

terms with the bank and ultimately the profit of bank will also increase. Jamal

and Naser(2002) and Beerli et al (2004) found the bank service quality as an

important antecedent of customer satisfaction which leads towards customer

loyalty. Jamal and Naser(2002) looked into the impact of service quality

dimensions and customer expertise on satisfaction. Three dimensions of bank

service quality are core (i.e. related to transaction accuracy and speed),

relational (i.e. related to bank staff behavior) and tangible (i.e. related to

bank layout) dimensions. Findings indicate that both core and relational

dimensions of are more linked to customer satisfaction. Findings also indicate

that customer expertise is negatively related to satisfaction.

Saulaite

et al (2000) conducted a study in Qatar to assess whether customer services provided

by banks are satisfactory to customers. Findings reveal that bank customers in

Qatar are satisfied for convenient location and layout, politeness of staff and

responsiveness to their needs. They are dissatisfied with bank interest rate

policies and fee charged. Kiser (2000) mentions that customer service and

location are the most cited for remaining with a bank. Holstius et al. (1995)

cited efficiency and courtesy of bank staff as the most important attributes in

determining overall customer satisfaction, while other important attributes Ire

convenience of location, range of services, reputation and availability of

innovations. Sureshchander et.al (2003) focuses on investigating the factors of

customer perceived service quality of three banks in India. The banks are

local, private and foreign bank. From study it comes to know that customers are

most satisfied with the foreign bank as compared to other banks. A foreign bank

provides the core services and other service in the standardized and simplified

process.

Nazmul (2005) prepared an article on “Measurement of

Customer Satisfaction of Credit Card Users”. This article has addressed around

the importance of measuring customer satisfaction of credit card. It is far

less costly to keep existing customers than to win new ones. Banks providing

credit cards should always keep on improving so as to achieve a greater

profitability. This can be achieved by knowing the market well and

understanding how products and services provide value for customers. Satisfaction

surveys and analyzes the customer feedback.

Approach To

The Problem

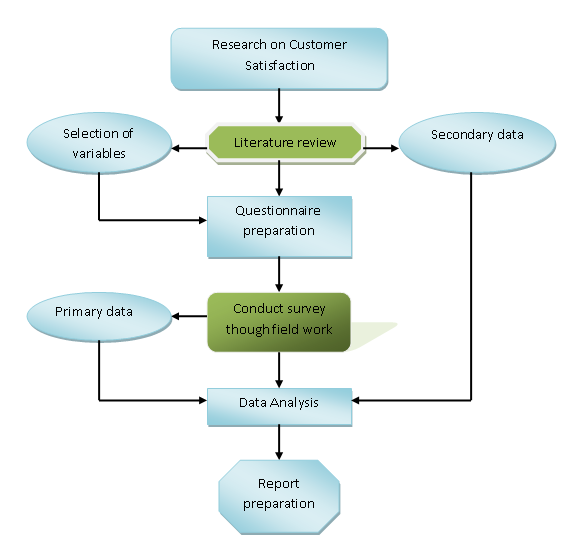

Research

Framework:

Conceptual

Framework:

In this study, the dependent

variable is “Customer satisfaction “.To find out the dependency of this

variable, 5 independent variables are selected. These independent variables

are: Reliability, Responsiveness, Assurance, Empathy, Tangibles.

Analytical model:

Our

principal analytical tool is linear regression model which is commonly known

as, the Working-Leser functional form. The form looks like this:

|

Y = Customer

Satisfaction

β 0 =

Constant ( intercept o the variable)

β 1 =

Coefficient of Reliability

X 1 =

Importance of Reliability

β 2 =

Coefficient of Responsiveness

X 2 =

Importance of Responsiveness

β 3 =

Coefficient of Assurance

X 3 =

Importance of Assurance

β 4 = Coefficient of Empathy

X 4 = Importance of Empathy

β 5 =

Coefficient of Tangibles

X 5 =

Importance of Tangibles

e =

Error

Other then this formula, other

descriptive statistical tools is being used in this paper like, frequency

distribution, crosstabs etc.

And

for SURVQUAL analysis, this method will be use:

|

Hypotheses:

Based

on the research question the following hypothesis has been developed:

Ho:

Reliability has no impact on customer satisfaction

H1:

Reliability has impact on customer

satisfaction

H0:

Responsiveness has no impact on customer satisfaction

H2:

Responsiveness has impact on customer satisfaction

H0:

Assurance has no impact on customer satisfaction

H3:

Assurance has impact on customer satisfaction

H0:

Empathy has no impact on customer satisfaction

H4:

Empathy has impact on customer satisfaction

H0:

Tangibles has no impact on customer satisfaction

H5:

Tangibles has impact on customer satisfaction

Research Design

Research

design is a framework or blueprint for conducting the marketing research

project. It specifies the details of the procedures necessary for obtaining the

information needed to structure and solve marketing research problems.

a.

Type of Research

Design

In

this study, Descriptive research

design has been applied to identify the factors related to customer

satisfaction of banks.

b.

Information

Needed

In

order to measure the customer satisfaction of different banks, bank account

holders have been used.

c.

Data Collection

To

conduct the study, both primary and secondary data were used and collected from

different sources. Primary data were collected from 100 respondents through

survey method.

Primary data sources

were students, service holders, businessmen and homemakers. In contrast, Secondary data sources were literature

reviewed.

d.

Scaling Technique

To

analyze the data collected through survey method, 9 (nine) point Likert scale

was used. Using this scale, the degree of agreement or disagreement with each

of statements regarding the factors determining customer satisfaction was

measured to evaluate the significance of those.

e.

Questionnaire

Development & Pretesting

A

questionnaire with 15 (fifteen) questions was developed for obtaining

quantitative primary data in this research. It had been pretested on 5

respondents before final data collection for more accuracy. Among these 15

(fifteen) questions; 10 (ten) were multiple choice, and 7 (seven) scale.

f.

Sampling

Techniques

The

sample was selected for this study based on the interviewers’ convenience.

Therefore, the sampling technique can be termed as ‘Convenient Sampling’ which

belongs to ‘Non-probability Sampling Technique’ category.

g.

Field Work

Field

work was conducted on 56 (Fifty Six) respondents. The sampling units include:

students, corporate personnel, businessmen and homemakers. The survey was

conducted throughout the Dhaka city.

Data Analysis

a.

Methodology:

The paper is done with both qualitative and quantitative research.

This has taken the form of descriptive and exploratory research. For this paper

we have used both primary and secondary data. Sources of data is mainly survey

but also articles journals etc. Primary data has been collected through survey

from throughout the Dhaka city and secondary data has been collected from

various published sources and internet.

We

have also used SURVQUAL model for this paper. As a way of trying to measure

service quality, researchers have developed a methodology known as SERVQUAL – a

perceived service quality questionnaire survey methodology. SERVQUAL examines

five dimensions of service quality.

Figure

5 - The five SERVQUAL dimensions of service

|

Dimensions

|

Description

|

|

Reliability

|

Performing

the promised service dependably and accurately.

|

|

Responsiveness

|

Helping

customers and providing a prompt service.

|

|

Assurance

|

Inspiring

trust and confidence.

|

|

Empathy

|

Providing

a caring and individual service to customers.

|

|

Tangibles

|

The

physical facilities and equipment available, the

appearance of staff; how easy

it is to understand

Communication

materials.

|

Source:

Mori (2002) Public Service Reform: Measuring and understanding customer

satisfaction

For

each dimension of service quality above, SERVQUAL measures both the expectation

and perception of the service on a scale of 1 to 9, 22 questions in total. The

Gap Score for each dimension is calculated by subtracting the Expectation score

from the Perception score. A negative Gap score indicates that the actual

service (the Perceived score) was less than what was expected (the Expectation

score). The Gap score is a reliable indication of each of the five dimensions

of service quality. Using SERVQUAL, service providers can obtain an indication

of the level of quality of their service provision, and highlight areas

requiring improvement.

Outlined

below are the instructions for carrying out a SERVQUAL survey and a sample of

the questions used in the questionnaire. In this sample, a bank is surveyed

however; any service organization can be surveyed using this questionnaire. All

that needs to be done is to substitute the word "bank" with the

particular organization or industry being surveyed.

1. Select the bank whose service quality we want to assess. Using the

questionnaire (see Appendix A below), obtain the score for each of the 22

Expectation statements, and then obtain the score for each of the 22 Perception

statements.

2. Obtain an average Gap Score for each dimension of service quality

by assessing the Gap Scores for each of the statements that constitute the dimension

and dividing the sum by the number of statements making up the dimension.

3. Sum the averages calculated in step 2 above and divide by 5 to obtain

an average SERVQUAL score.

Data

is analyzed by with the help of SPSS (Anne Swindle, Punam Ohri-Vachaspati 1999,

2005). For this paper the researcher has used regression analysis (Marie .T

Ruel, Nicholas Minto, Lisa Smith, 2005), linear method (Anne Swindle, Punam

Ohri-Vachaspati 1999, 2005), descriptive analysis has been used.

b. Plan

of Data Analysis

To

facilitate the analysis of collected data, frequency distribution, cross

tabulation regression analysis and SERVQUAL have been performed. Frequency distribution has conducted to

count the number of responses associated with different values of the factors. Cross Tabulation has been used to

reflect the joint distribution of the factors and services with the basic

information of the customers. Regression analysis has been conducted to

identify the important factors. Finally SERVQUAL analysis has been performed to

measure the level of customer satisfaction.

Result and Findings

Analysis:

Consumer

perception:

Table-

5.1.1: Occupation* Currently using bank account cross tabulation

|

Occupation

|

Currently using bank account

|

Total

|

|

|

Savings account

|

Current account

|

||

|

Student

Service

Business

|

32

8

10

|

0

0

10

|

32

4

20

|

|

Total

|

56

|

5

|

56

|

From

the above table it is clear that students and service holder prefer to have a

savings account, whereas most of the business person has a current account.

Chart-

5.1.1: Education level

Most

of the respondents of BANK (46%) have completed graduation; among the others are

respondents having completed undergraduate/bachelor (25%), HSC (17.9%) and SSC

(10.7%).

|

Using

bank account

|

Customer

type

|

Total

|

|

|

General/Personal

|

Corporate/Business

|

||

|

Savings

account

Current

account

|

38

2

|

8

8

|

46

10

|

|

Total

|

40

|

16

|

56

|

Table-

5.1.2: Customer type* Currently using

bank account cross tabulation

This

table clearly indicates that, savings account is mainly popular among the

general people compared to the business people.

Table-

1.2 (Appendix) shows that most of the customer holds only one bank account

(53.6%), followed by respondents who have two accounts (28.5%) and so on. It is

surprising that 3.6% of the respondents have five or more number of accounts.

Chart-

5.1.2: Whether bank charges are fare

Among

the respondents 64.3% have agreed that Bank charges fare amounts for the

services offered by it, whereas 21.4% of the respondents are neutral to this

statement and 14.3% respondents have disagreed the statement.

Table-

5.1.3: Considerations in opening a bank account

|

Factors

|

Most

recalled

|

|||

|

1st

|

2nd

|

3rd

|

4th

|

|

|

Customer

service

Environment

Reputation

Personalized

service

Easy

of screen use

Quick

response

Convenience

Employee

behavior & bank environment

Wide

branch network

ATM

network

Continuous

service

|

78.6

14.2

0.0

0.0

0.0

3.6

0.0

0.0

0.0

3.6

0.0

|

0.0

72.0

12.0

4.0

4.0

4.0

0.0

0.0

4.0

0.0

0.0

|

0.0

0.0

48.0

8.0

0.0

32.0

4.0

0.0

0.0

8.0

0.0

|

0.0

0.0

0.0

18.2

0.0

36.4

36.4

0.0

9.0

0.0

0.0

|

The

table shows that the primary considerations while opening a bank account is

customer service (78.6%) followed by

environment (14.2%), quick response (3.6%) and ATM network (3.6%). In

their second recall environment was positioned at the top with 72%, followed by

reputation (12%) and the others and in their third recall reputation is the key

factor (48%) followed by quick response (32%) and so on.

Chart-

5.1.3: Taking bank services

ATM

services (89.2%) have been found as the mostly taken services among all the

services taken by the customers.

Table-

5.1.4: Wanted future facilities

|

|

Most

expected

|

||

|

1st

|

2nd

|

3rd

|

|

|

Internet

banking

E-mail

banking

Banking

system by personal representatives anywhere

Mobile

(place) banking

Street

banking system

Phone

banking

|

60.7

3.6

0.0

32.1

0.0

3.6

|

5.6

77.8

5.6

5.6

5.6

0.0

|

0.0

0.0

5.9

64.7

0.0

29.4

|

In

their first recall the customers mainly expressed that they expect to have

internet banking (60.7%) followed by mobile (place) banking (32.1%), e-mail

banking (3.6%) and phone banking (3.6%) as future facilities to be delivered by

the bank. In the second recall e-mail banking (77.8%) was placed first followed

by internet banking, mobile banking, etc. with 5.6% each and in the third

recall mobile banking stands at the top with 64.7%, followed by phone banking

(29.4%)

Table-

5.1.5: Known products and services

|

Factors

|

Most recalled

|

|||

|

|

1st

|

2nd

|

3rd

|

4th

|

|

Mobile

banking

Deposit

scheme

Vehicle

loan

SME

banking

Savings

account

Debit

card

ATM

services

SMS

banking

Personal

loan

Foreign

currency

|

82.2

10.7

0.0

0.0

7.1

0.0

0.0

0.0

0.0

0.0

|

0.0

51.9

3.7

22.2

18.5

0.0

3.7

0.0

0.0

0.0

|

0.0

0.0

18.5

25.9

22.2

3.7

25.9

0.0

3.7

0.0

|

0.0

0.0

0.0

18.5

25.9

14.8

11.1

3.7

22.2

3.7

|

Among

the respondents most of them knows about mobile banking (82.2%), followed by

deposit scheme (10.7%) and savings account (7.1%). Deposit scheme (51.9%) is

mainly known to them, followed by ATM services (25.9%), savings account (22.2%)

and others in the second recall, and in case of third recall savings account

(25.9%) stands at the top followed by personal loan (22.2%), SME banking

(18.5%) and others.

Table-

5.1.6: Customer service responsiveness

|

Factors

|

Most

recalled

|

|||

|

1st

|

2nd

|

3rd

|

4th

|

|

|

Call

answering time

Flawless/Correct

operations

Speed

of conducting operations

Knowledge

about products and services

Understanding

and replying queries correctly

Communication

skills/positive approach

|

71.4

10.7

10.7

0.0

3.6

3.6

|

40.0

48.0

0.0

8.0

0.0

4.0

|

0.0

0.0

37.5

25.0

33.3

4.2

|

0.0

0.0

0.0

30.0

25.0

45.0

|

The

table shows that in case of case of customer service responsiveness, the

respondents prefer call answering time (71.4%) mostly and flawless/correct

operations (10.7%), speed of conducting operations (10.7%) etc. follows it

respectively. In the second recall flawless/correct operations (48.0%) stands

at the top and in the third recall speed of conducting operations is found to

be the most important factors.

Most important factors:

Regression analysis:

To measure the satisfaction of the

bank account holders, the perception of the customers (performance of the case

study banks) on SERVQUAL dimensions have been measured. The dimensions have

been measured through a number of questions for each dimension.

In conducting the multiple

regression analysis, the mean value of the responses of the questions under

each dimension is considered as the score of that dimension. After calculating

the mean scores of the five dimensions (for each respondent) have been

regressed on the satisfaction scores (dependent variables) of corresponding

respondents.

|

Table- 5.1.7: Model summary

|

||||

|

Model

|

R

|

R Square

|

Adjusted R Square

|

Std. Error of the Estimate

|

|

1

|

.674a

|

.455

|

.331

|

.92723

|

|

a. Predictors: (Constant), Average scores of tangibles, Average

scores of responsiveness, Average scores of assurance, Average score of

reliability, Average scores of Empathy

|

||||

R2

indicates the strengths of

association among the independent and dependent variables. The higher the value

of R2 , the higher the strength of association among the dependent

and independent variables. R2 shows how much the variation in the dependent

variables can be explained by the variation in the independent variables. The

value of R2 in this case is .455 which implies that 45% variation in

dependent variables is due to the variation in the independent variables.

To

justify whether the R2 in the case at hand is significant or not, we

will have to analyze the value of F statistics. The calculated value of F

statistics is 3.667(Appendix) which is significant at 0.015 (at the level of

significance of 0.05). As the significance value is smaller than .05, the model

in the case at hand is significant.

|

Table-

5.1.8: Coefficients

|

||||||

|

Model

|

Unstandardized Coefficients

|

Standardized Coefficients

|

t

|

Sig.

|

||

|

B

|

Std. Error

|

Beta

|

||||

|

1

|

(Constant)

|

.449

|

.853

|

|

.527

|

.604

|

|

Average score of reliability

|

.173

|

.111

|

.316

|

1.562

|

.133

|

|

|

Average scores of responsiveness

|

-.074

|

.099

|

-.126

|

-.748

|

.462

|

|

|

Average scores of assurance

|

-.046

|

.102

|

-.078

|

-.453

|

.655

|

|

|

Average scores of Empathy

|

.272

|

.127

|

.440

|

2.143

|

.043

|

|

|

Average scores of tangibles

|

.019

|

.107

|

.038

|

.175

|

.863

|

|

|

|

|

|

|

|

||

From the Coefficients Table, we can

see the standardized coefficient beta calculated for each of the predictor

dimensions (SERVQUAL dimensions) showing the percentage of the variation in the

dependent variable (customer satisfaction) explained by each of the independent

variables. The table reveals that the Empathy dimension has the standardized

beta coefficients of 0.440 or 44% which is greater than that of the other

dimensions. The beta coefficient of Empathy (0.440) is significant at 0.043

which is lower than 0.05 indicating the rejection of null hypothesis “Empathy

has no impact on customer satisfaction”.

Thus the empathy dimension is found to be significant determinant of

satisfaction while the other dimensions are not found to be significant

predictor of customer satisfaction of Bank.

|

Dimension

|

Statement

|

Expectation

score

|

Perception

score

|

Gap

score

|

Average

for dimension

|

|

Reliability

|

1

|

8.36

|

5.93

|

-2.43

|

-2.55

|

|

2

|

7.86

|

5.64

|

-2.22

|

||

|

3

|

7.61

|

5.50

|

-2.11

|

||

|

4

|

7.86

|

4.43

|

-3.43

|

||

|

Responsiveness

|

1

|

7.86

|

5.96

|

-1.90

|

-1.64

|

|

2

|

7.89

|

6.07

|

-1.82

|

||

|

3

|

7.04

|

5.82

|

-1.22

|

||

|

Assurance

|

1

|

8.11

|

5.64

|

-2.47

|

-2.01

|

|

2

|

7.86

|

6.39

|

-1.47

|

||

|

3

|

7.89

|

5.54

|

-2.35

|

||

|

4

|

8.04

|

6.29

|

-1.75

|

||

|

Empathy

|

1

|

7.68

|

3.89

|

-3.79

|

-3.80

|

|

2

|

7.43

|

3.04

|

-4.39

|

||

|

3

|

7.82

|

4.61

|

-3.21

|

||

|

Tangibles

|

1

|

8.43

|

5.96

|

-2.47

|

-2.59

|

|

2

|

8.07

|

5.64

|

-2.43

|

||

|

3

|

8.21

|

5.39

|

-2.82

|

||

|

4

|

8.00

|

5.36

|

-2.64

|

||

|

Average

SERVQUAL score

|

-2.52

|

||||

Table- 5.1.9: SERVQUAL

SERVQUAL

scores having negative value means that the customer satisfaction is negative,

contrary positive SERVQUAL implies the customer satisfaction is positive. The

average SERVQUAL score for Bank is -2.52 which means that the customers are not

satisfied with the bank.

Recommendation

and Conclusion

Customer dissatisfaction

occurs when the customer does not get what she expected. When a product does

not behave as promised or a service is not delivered as expected, the customer

becomes - a dissatisfied customer. Find out where customer satisfaction stands.

Ask customers what they like and dislike about the company. The customer and

the business

may have different ideas of what needs to be fixed.

The above graph sows that

customer service plays a vital role in customer’s loyalty. And if the customers

are not satisfied with the overall service off the organization.,

The most effective way to

improve customer satisfaction for any organization are the followings –

Processes

Customer dissatisfaction arises primarily

from breakdowns within a company. Often, bottlenecks in the process cause the

customer not to get the service he expected. A bottleneck occurs when outputs

are significantly slower than inputs. For example, if it takes two minutes to

assemble the bottom of a jewelry box, but six minutes to assemble the top of

the box, then the bottleneck occurs at the assembly of the top of the jewelry

box. As a result, over the course of 30 minutes, 15 box bottoms go in, but only

five box tops go out, which holds up box production. To begin solving process

problems, map the process. A flowchart is a visual representation of the

process. This gives management and other stakeholders the opportunity to see

how one part of the process affects another part. The team can determine which

actions to start performing or stop performing.

Technology

Information Technology (IT) is the

backbone of a company's infrastructure. Check to ensure the information systems

can handle the volume and type of business. Questions that management should

ask of itself: Are the computer systems outdated?

Are the systems maintained properly? Are customer records accurate or

duplicated? Should systems be customized? Hire a consultant to review the

company's technology needs vs. the technology the company currently uses. For

customer records, create an internal, cross-functional project team to

standardize customer records. Create procedures/best practices for entering

customer records, and then train the staff on the new procedure. Periodically,

audit customer records to keep them accurate and standardized.

People

Having the right people performing the job is very important. Are your customer service personnel

impatient? Is your management board? Assess the job skills and interests of the

staff. If they are not engaged, customer satisfaction can suffer. Additional

job responsibilities can increase employee satisfaction. Use the employee to

help solve customer satisfaction problems the customer is experiencing, thereby

satisfying the customer and giving the employee a new skill set by working on

the project.

Here are our suggestions to improve the satisfaction rate -

1.

Stay in contact with customers on a regular basis. Offer them a free e-zine

subscription. Ask customers if they want to be updated by e-mail when you make

changes to your Web site. After every sale, follow-up with the customer to see

if they are satisfied with their purchase.

2.

Create a customer focus group. Invite ten to twenty of your most loyal

customers to meet regularly. They will give you ideas and input on how to

improve your customer service. You could pay them, take them out to dinner or

give them free products.

3. Make it easy for your customers to navigate

on your web site. Have a "FAQ" page on your Web site to explain

anything that might confuse your customers. Ask them to fill out an electronic

survey to find out how make your web site more customer friendly.

4.

Resolve your customers’ complaints quickly and successfully. Answer all e-mail

and phone calls within an hour. If possible, you the owner of the business,

personally take care of the problem. This will show your customers you really

care about them.

5. Make it easy for your customers to contact

you. Offer as many contact methods as possible. Allow customers to contact you

by e-mail. Hyperlink your e-mail address so customers won't have to type it.

Offer toll free numbers for phone and fax contacts.

6.

Make sure employees know and use your customer service policy. Give your employees

bonuses or incentives to practice excellent customer service. Tell employees to

be flexible with each individual customer, each one has different concerns,

needs and wants.

7.

Give your customers more than they expect. Send thank you gifts to lifetime

customers. E-mail them online greeting cards on holidays or birthdays. Award bonuses

to your customers who make a big purchase.

8. Always be polite to your customers. Use the

words your welcome, please, and thank you. Be polite to your customers even if they

are being irate with you. Always apologize to your customers should you make a

mistake. Admit your mistakes quickly and make it up to them in a big way.

9.

Reward customers a point for every one dollar they spend. Let's say customers

can get a free computer for 300 points. That means customers will spend $300

dollars on your products and services to get enough points to get the free

computer.

10.

Build strong relationships with your customers. Invite them to company

meetings, luncheons, workshops or seminars. Create special events for your

customers like parties, barbecue's, dances etc. This will make them feel

important when you include them in regular business operations and special

events.

References

Ahmad Jamal, Kamal Naser(2002), “Customer satisfaction and retail

banking: an assessment of some of the key antecedents of customer satisfaction

in retail banking”, International Journal of Bank Marketing 20/4,146-160

AF- www.emeraldinsight.com/journals.htm?articleid=1610219&show=pdf

[accessed

10th November, 2010]

Anderson,

Eugene W., Claes Fornell, and Donald R. Lehmann (1994), “Customer Satisfaction,

Market Share, and Profitability: Findings from Sweden,” Journal of Marketing,

58 (3), 53-66.

AF-

www.theacsi.org/index.php?option=com_content&task=view&id=50&Itemid=122

[accessed

10th November, 2010]

Anderson,

Eugene W., Claes Fornell, and Roland T. Rust (1997), “Customer Satisfaction,

Productivity, and Profitability: Differences Between Goods and Services,”

Marketing Science, 16 (2), 129-145.

AF-

http://bear.warrington.ufl.edu [accessed 10th

November,

2010]

Anderson,

Eugene W. and Mary W. Sullivan (1993), “The Antecedents and Consequences of

Customer Satisfaction for Firms,” Marketing Science, 16 (2), 129-45

AF-

www.jstor.org/stable/184036

[accessed

10th November, 2010]

Anderson,

Eugene W. and Vikas Mittal (2000), “Strengthening the Satisfaction-Profit Chain,” Journal of Service Research, 3

(2), 107-120.

AF-

www.uni-weimar.de/medien/.../lehre/.../andersonmittal_2000_jsr.pdf

[accessed

10th November, 2010]

Beerli, A., Martin, D. Josefa, and Quintana, A. (2004), “A model

of customer loyalty in the retail banking market“, European Journal of

Marketing, Vol. 38 No. 1/2,pp. 253-275 Available from: www.emeraldinsight.com/journals.htm?articleid=853921

[accessed 15th November, 2010]

Bena.

I, 2010, EVALUATING CUSTOMER SATISFACTION IN BANKING SERVICES, Management

& Marketing , Vol. 5, No. 2, pp. 143-150;

AF

- www.managementmarketing.ro/pdf/articole/188.pdf,

[accessed 15th November, 2010]

Cohen.

D, Gan. C, Yong. H. H. A and Choong. E; CUSTOMER SATISFACTION: A STUDY OF BANK CUSTOMER RETENTION IN NEW

ZEALAND;

AF

- www.lincoln.ac.nz/Documents/2308_DP109dc_s6473.pdf

[accessed 15th

November, 2010]

DeWulf,

Kristof, Gaby Odekerken-Schröder, and Dawn Iacobucci (2001), “Investments in

Consumer Relationships: A Cross-Country and Cross-Industry Exploration,”

Journal of Marketing, 65 (4), 33-50.

AF- www.atypon-link.com/AMA/doi/abs/10.1509/jmkg.65.4.33.18386

[accessed

10th November, 2010]

Drucker,

Peter F. (1954), The Practice of Management, New York: Harper & Row

AF-

www.questia.com/PM.qst?a=o&d=55843924

[accessed

10th November, 2010]

No comments:

Post a Comment